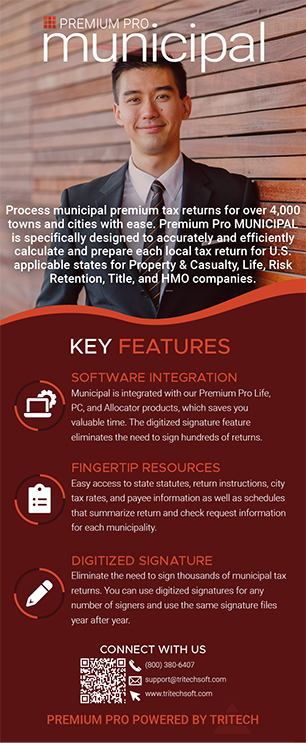

KEY FEATURES

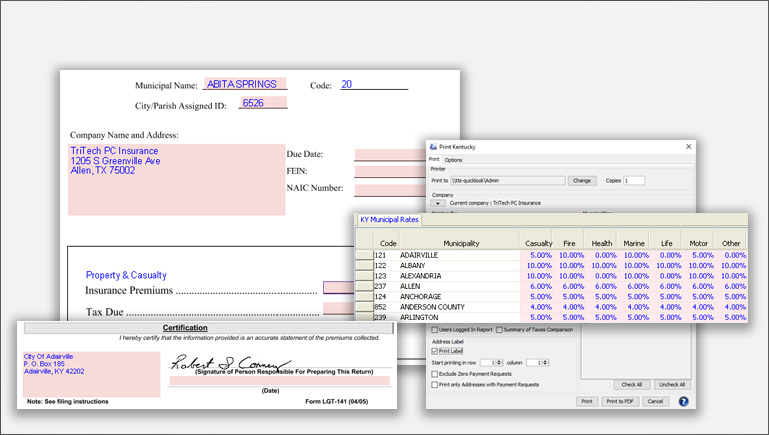

PREMIUM & ALLOCATOR INTEGRATION

Municipal is integrated with our Premium Pro Life, PC, and Allocator products, which saves you valuable time. The digitized signature feature eliminates the need to sign hundreds of returns.

FINGERTIP RESOURCES

Easy access to state statutes, return instructions, city tax rates, and payee information as well as schedules that summarize return and check request information for each municipality.

DIGITIZED SIGNATURE

Eliminate the need to sign thousands of municipal tax returns. You can use digitized signatures for any number of signers and use the same signature files year after year.

PREMIUM & ALLOCATOR INTEGRATION

Municipal is integrated with our Premium Pro Life, PC, and Allocator products, which saves you valuable time. The digitized signature feature eliminates the need to sign hundreds of returns.

FINGERTIP RESOURCES

Easy access to state statutes, return instructions, city tax rates, and payee information as well as schedules that summarize return and check request information for each municipality.

DIGITIZED SIGNATURE

Eliminate the need to sign thousands of municipal tax returns. You can use digitized signatures for any number of signers and use the same signature files year after year.

EASY DATA IMPORT

Import Data from Allocator, create your own data import file, or even copy and paste into a centralized schedule where premiums for all municipalities can be managed in one location.

PROCESS MANAGEMENT

Analyze taxes, fees, credits, and track season-to-season changes on a jurisdiction basis.

TAX FORM MARKUP

Comment and markup tax forms as you go with our drawing, sticky notes, stamps, signature, and reference tools

ON-DEMAND CALC & REVIEW

Calculate and review taxes at any stage of the process based on your jurisdiction’s filing requirements and tax laws.

ONE-STEP AMENDED RETURNS

Prepare amended returns while retaining access to the original

SUPPORTED STATES

Alabama, Florida, Georgia, Illinois, Kentucky, Louisiana, New Jersey, New York, North Dakota, & South Carolina

ALABAMA

Insurance company municipal business licenses tax for Alabama Fire & Marine and other Alabama insurance companies. Includes the City of Mobile, and the Mobile Police and Fire Pension Fund, Tuscaloosa Fireman’s Pension Fund, and Birmingham Firemen’s Pension returns. Includes the Revenue Discovery Systems (RDS).

FLORIDA

Occupational license (Chapter 205 of FL Statutes)

Business Tax Receipts Fee for insurance companies as outlined in Chapter 205 of the state of Florida Statutes.

GEORGIA

License Fees (33-8-8 of Georgia Code)

License Fees payable to each municipality as outlined in 33-8-8 of the Georgia Code. Municipal Tax data integrates with PREMIUM Pro Premium Tax Life Return GID-17A.

ILLINOIS

Foreign Fire Insurance Company Tax

Includes the Illinois Municipal League Fire Department Tax Schedule and returns for four nonparticipating municipalities. Information can be exported to the league’s Excel spreadsheet for further customization.

KENTUCKY

Premium tax (LGT-140, LGT-141, & LGT-142)

PREMIUM Pro Municipal sources city premiums and taxes to the applicable county’s LGT-142. Tracks tax over-payment credits from quarter to quarter. Municipal taxes paid source to PREMIUM Pro Life & PC returns as necessary for inclusion in retaliatory calculations. Export and electronic filing available for annual reconciliation returns.

LOUISIANA

License tax (1076 of Louisiana Revised Statutes)

Local License for Life and PC companies. Includes LaMats form 478 for league filing and individual returns for non-participating municipalities and parishes. Exports LaMats return to a text file that can be uploaded to the league’s website. Municipal Data seamlessly integrates with PREMIUM Pro Life and PC return 1076 (Louisiana Revised Statues). Allocate variance from Form 1076.

NEW JERSEY

New Jersey Firemen’s Relief Tax on premiums of Foreign Fire Insurance Companies.

Pursuant to section 54:18-1 of chapter 18 of title 54 of the revised statutes of the state of New Jersey. The tax data can be exported to an Excel spreadsheet and filed online.

NEW YORK

Buffalo Foreign Fire Tax Report, NYC Foreign Fire Premiums Tax Report, Cover Letter for NY State Foreign Fire Tax Report

NORTH DAKOTA

North Dakota Fire District Report (SFN 52764)

You can use the Export Fire District Report option to export the data to an Excel spreadsheet and email it to the North Dakota Insurance Department.

SOUTH CAROLINA

Municipal Association of SC (MASC)

MASC Insurance Tax Collection Program returns for Life and PC companies. Tax information can be exported into an ASCII file that is submitted to MASC. Allocate variance between Schedule 5 of the Annual Premium Tax return and total premiums entered into the Municipal Input Schedule.

OPTIMIZED WORKSPACE

Easy sidebar and power icon navigation within a dockable interface that provides a flexible and customized workspace.

INTEGRATED CHECK & BALANCE

Customized alerts and integrated audit controls provide on-the-go checks and balances encouraging an error-free optimized prep experience

TEAM COLLABORATION

Integrated notifications as well as comment and markup tools keep your team communicating, informed, and on task.

INCREASED CAPACITY

Municipal streamlines the jurisdiction filing complexities, saving time while ensuring confidence in the tax preparation process maximizing team resources and building team success.

EMPOWERED MANAGEMENT

Premium Pro Municipal summarizes the municipal tax information, including Summary of Taxes and Check Request Schedules, making the information easy to review. Automation offers an unbeatable combination of features to maximize productivity and efficiency.

IMPROVED ACCURACY

Improves the accuracy of municipal tax returns across multiple states and thousands of jurisdictions. Ensures your team has the power tool needed for tax season success.