Welcome to Stratus Allocator Pro!

Allocator determines the physical location of addresses using geographic mapping technology. Once the physical address is identified, the program can determine the relevant taxing jurisdiction for that address.

The program uses an extensive database comprised of addresses and address ranges for each state. The program searches this database to find an address that matches the address listed on the policy. The data returned is called a matched address.

The program uses an extensive database comprised of addresses and address ranges for each state. The program searches this database to find an address that matches the address listed on the policy. The data returned is called a matched address.

The location of the matched address is plotted against a digital map of the state. This map includes city, county, and fire district boundaries, so Allocator is able to identify precisely where the address is located.

This process is called geocoding.

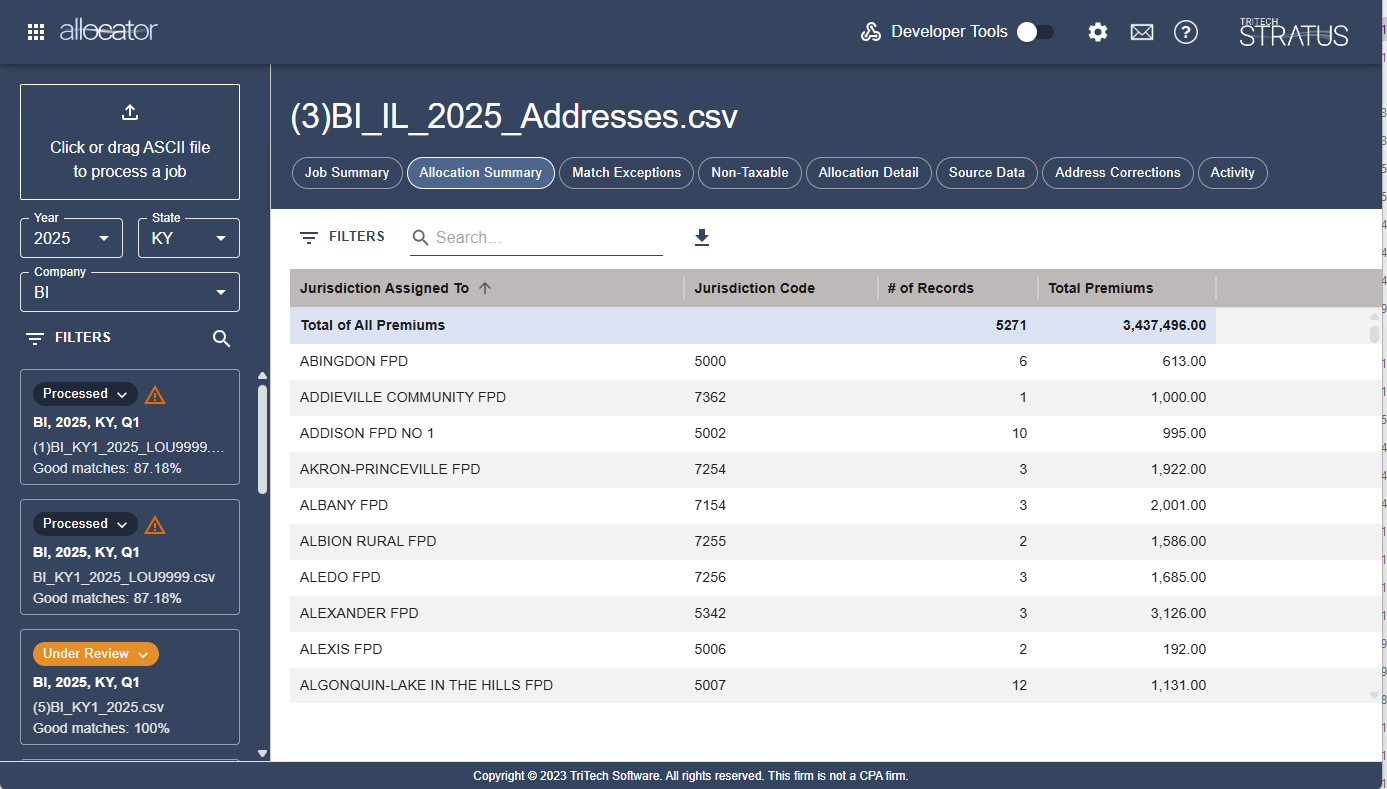

After the address is geocoded, Allocator determines the proper taxing jurisdiction to which the address is assigned. This jurisdiction may be a city, county, or fire district This process is called allocation. The results of the allocation process can be imported into Municipal and the Life/P&C Annual Tax software modules.

Stratus Allocator currently supports: Alabama, Delaware, Florida Firefighters and Police Officers Pension Fund, Georgia, Illinois Foreign Fire, Kentucky, Louisiana, New York Fire, New York MTA, North Dakota, and South Carolina.