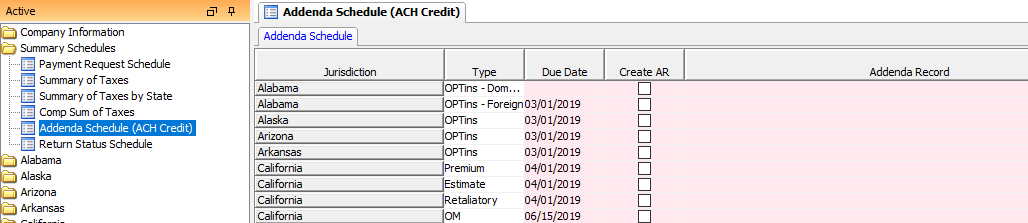

The Addenda Schedule is for use with ACH credit payments. When a particular state calls for your bank information, you may use this schedule to store your bank information for easy access. Also, much of the information required to create an addenda record is sourced in to the Addenda Schedule and it's capable of creating an addenda record that you may send to your bank so that the state can be paid.

The “Create AR” checkbox selections and the Taxpayer ID columns, as well as the Company Banking Information will rollover from year to year. The Addenda Records will also be pushed to the Payment Request forms.

As efiling becomes more prevalent, electronic payment via ACH credit or debit is increasingly required by states as well. When a particular state (i.e. MN, NY) requests your banking information for ACH debit payments as part of the efiling process through our software, you will need to enter your bank account and routing numbers to process those filings and payments.

Additionally, payment via ACH credit requires the generation of a NACHA file. A NACHA file is the method banks use to transmit multiple pieces of information along with the payment amounts. Information such as company identifiers, tax types, amounts, and tax periods can all be included. The NACHA file set by the banking industry has a standard layout for most of the data elements. However, each state can require a different set of information for the ADDENDA on line 7 of this NACHA file.

To help facilitate the myriad of payment methods available, you may utilize the Addenda Schedule. The Addenda Schedule has a designated area to store your banking information for easy access. For states that require the ACH debit payment method, your banking information will transfer to the appropriate fields on the returns. All information is encrypted to help prevent unauthorized use of the data. Only users with the appropriate rights granted by your Enterprise Admin user can access this information.

States that allow for ACH credit payments are also listed on the Addenda Schedule. Required data from the returns as well as state specific items will be recorded on this schedule. A complete addenda record will be generated for each payment required. This information can then be used to generate an addenda record, which contains remittance and other information. This detail can then be provided to your treasury or finance department to facilitate payments.

Our website address: www.tritechsoft.com

Our mailing address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions? You can reach us at 1-800-380-6407

Or contact Support here.

©1995-2019 TriTech Software Development Corp. ©2006-2019 TriTech Services Inc. All rights reserved. Premium Pro® is a registered trademark.