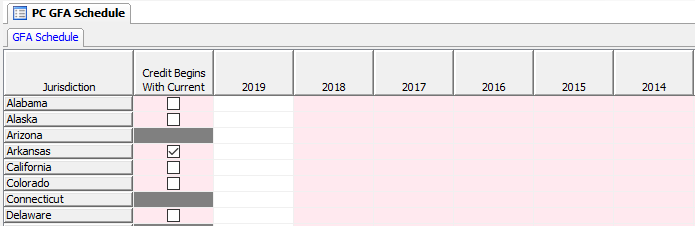

These schedules provide a centralized location to enter Guaranty Fund Assessments paid for all states over a twelve-year period. The assessment amounts entered for each year will be retained and rolled forward to the following year’s software. Therefore, after the first year, you only need to enter the current year’s assessments.

The GFA credits are calculated for each state using the assessment amounts entered on this schedule and the state law concerning Guaranty Fund Assessments. Only the actual assessment amount you are eligible to take credit for should be entered in the schedule. You may also select to calculate the GFA credit beginning with the current year. Otherwise, the calculations will start from the year following the assessment. For Property and Casualty Companies, there are separate schedules for AH and PC GFA assessments.

Our website address: www.tritechsoft.com

Our mailing address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions? You can reach us at 1-800-380-6407

Or contact Support here.

©1995-2019 TriTech Software Development Corp. ©2006-2019 TriTech Services Inc. All rights reserved. Premium Pro® is a registered trademark.