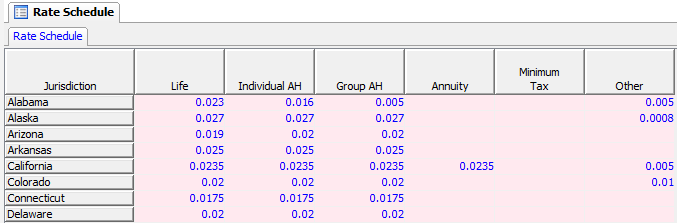

The Rate Schedule allows you to review and adjust any tax rate that a state may charge your company. It is recommended that you review these rates and, if necessary, adjust them on the Rate Schedule instead of on the return. In addition to state rates, this schedule also includes a column for minimum taxes if applicable for a given state. Any overridden values/changes to default numbers will transfer from year to year.

Our website address: www.tritechsoft.com

Our mailing address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions? You can reach us at 1-800-380-6407

Or contact Support here.

©1995-2019 TriTech Software Development Corp. ©2006-2019 TriTech Services Inc. All rights reserved. Premium Pro® is a registered trademark.