Premium Pro Help

Louisiana

The due date and a description of the license tax calculation can be

found in the Louisiana Revised Statutes. Some municipalities may indicate

a due date that is different from that mentioned in the statute. Required

data for the input schedule is taxable premiums as prescribed by LRS 22-833.

The tax schedule for selected municipalities may differ from the maximum

tax schedule stated in the statute. The statute prescribes different schedules

for Life/Accident Insurance premiums and Other Insurance premiums.

Taxes for a number of municipalities are collected by Louisiana Municipal

Advisory and Technical Services (LaMATS) as prescribed by LRS 22:834.

A separate return is generated for these cities. Only one payment is required

when filing this return.

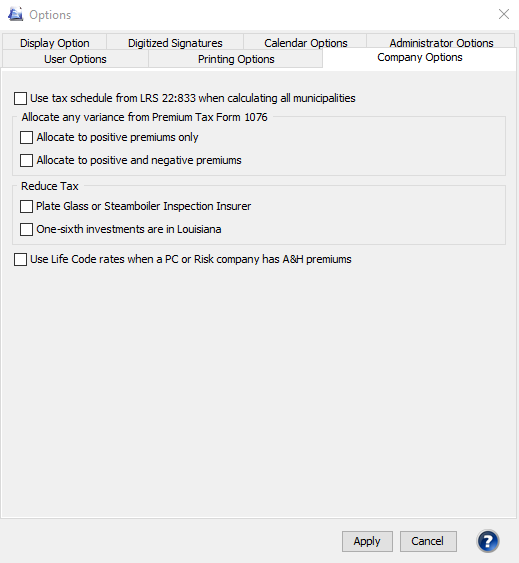

Louisiana Company Options

The Company Options tab includes these options:

- Use tax schedule rate from LRS 22:833 when calculating all municipalities.

Select this option to calculate the tax for all municipalities using

the schedule prescribed by state statute.

- Allocate Variance from Form 1076 Page 4 Line C

- Allocate to positive premiums only. Select this option

to allocate the Form 1076 variance over municipalities with positive

premiums only.

- Allocate to positive and negative premiums. Select this

option to allocate the Form 1076 variance over all municipalities.

- One - Sixth investments are in Louisiana will reduce the tax

payable to 1/3 of the regular tax. This option should be checked

if 1/6 of the total admitted assets of the payer are invested and

maintained in qualifying Louisiana investments (LRS 22:832(B)). A

message will print on the return indicating that 1/3 of the standard

tax is paid.

- Plate Glass or Steam boiler Inspection Insurers. Plate glass

and steam boiler inspection insurers should select this option. Selecting

this option generates a tax 1/3 of the standard tax. A message will

print on the return indicating that 1/3 of the tax is paid.

- Use Life Code rates when a PC or Risk Company has A&H premiums.

When selected, the rate schedule used to generate a tax for a PC or

Risk company will be the rate schedule used for a life company. For

example, The PC code tax schedule for Abita Springs is X, but if the

option is select, the Life code tax schedule of A will be used instead.

Steps to Change

LA Municipal Company Options

- Load the Louisiana Municipal

Module.

- Go to the Tools Menu and select

Options.

- Select the Company Options

tab and then check the options you would like to enable and then click

Apply.

Our website

address: www.tritechsoft.com

Our mailing

address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions?

You can reach us at 1-800-380-6407

Or

contact Support

here.

©1995-2019

TriTech Software Development Corp. ©2006-2019 TriTech Services Inc. All

rights reserved. Premium Pro® is a registered trademark.