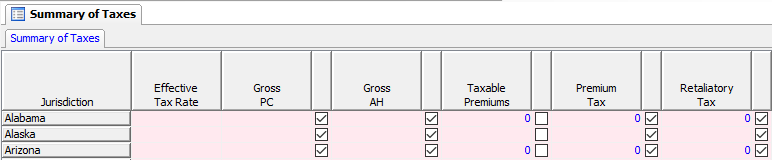

The Summary of Taxes pulls your Schedule T numbers for gross premiums and sources in all of the appropriate information from each return. It uses this information to calculate an effective tax rate. You can change the columns that are included in the calculation of your effective tax rate by checking or un-checking the box following the specific column. You can also use this area to see each column total for all the states. In addition, there are also columns for Overpayment Applied to Estimates and Tax Refund. This allows you to have an overview of all overpayments and refunds for all states. Columns for Refund Amount Received and Refund Date Received are included in the Summary of Taxes. These columns are for reporting purposes only.

By default, the Summary of Taxes lists all the states, but you have the option of only displaying your active states. To do so, right-click on any of the column headings in the schedule and select Show Only Active Jurisdictions. If you wish to have all states displayed again, you can turn the option off.

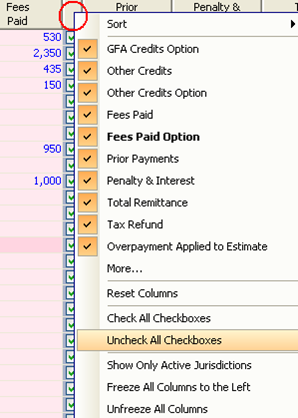

You can check or uncheck the options for an entire column. To do so, select the column by clicking in the header above the check boxes. Then right-click on a selected check box and choose Check All or Uncheck All Checkboxes.

You may also view the information found in the Summary of Taxes Schedule on a state by state basis by going to the Summary of Taxes by States Schedule. This schedule is identical to the Summary of Taxes Schedule, but it may be more convenient to isolate the information you are looking for by state.

Our website address: www.tritechsoft.com

Our mailing address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions? You can reach us at 1-800-380-6407

Or contact Support here.

©1995-2019 TriTech Software Development Corp. ©2006-2019 TriTech Services Inc. All rights reserved. Premium Pro® is a registered trademark.