Premium Pro Help

Summary of Taxes Comparison Report

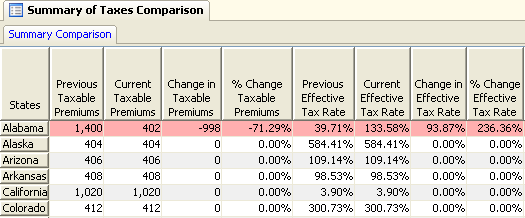

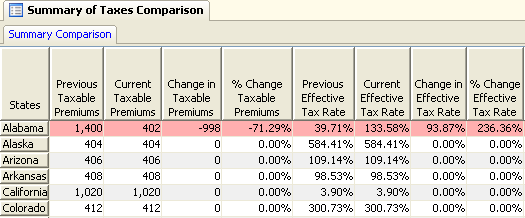

The Summary Comparison report allows you to compare values in the Summary

of Taxes in the current year to values in the prior year.

Steps to view the Summary Comparison Report

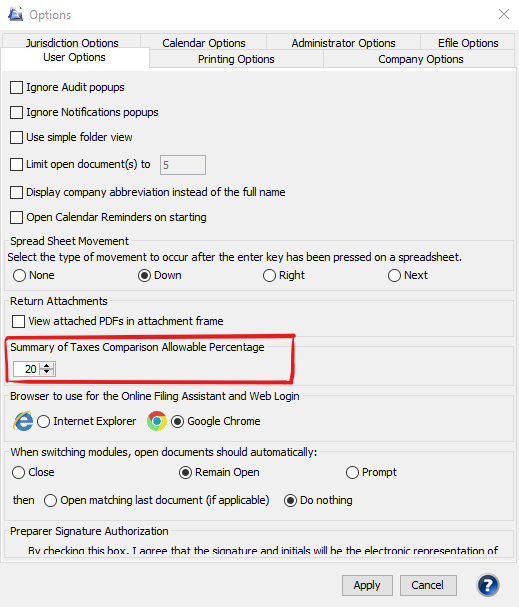

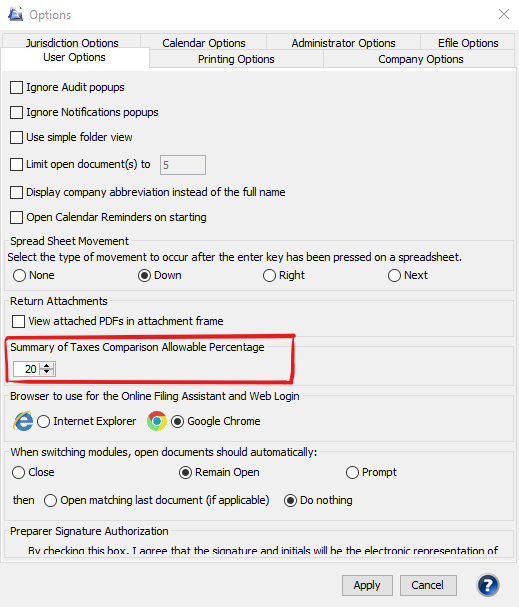

- Set an allowable variance percentage. Any item over this amount

will be highlighted in the report. Go to Tools>Options>User

Options tab. Then choose the percentage under Summary of Taxes

Comparison Allowable Percentage. Click Apply.

- Open the report. From the Report menu select View Summary Comparison

Report. Report>View Summary Comparison Report

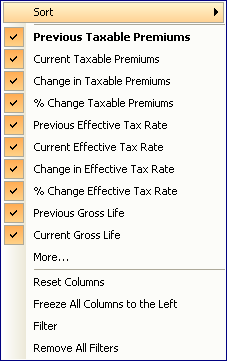

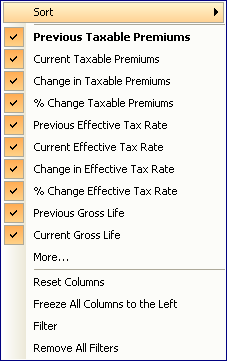

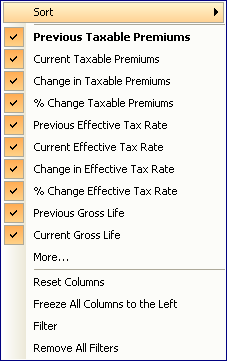

- You may right click on the column headings to choose which columns

you would like to display. Uncheck a column name if you do not want

it to be visible on the report. Choose More for more column choices.

For information on Sorting

and Filtering, please see the corresponding help topic.

Our website

address: www.tritechsoft.com

Our mailing

address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions?

You can reach us at 1-800-380-6407

Or

contact Support

here.

©1995-2019

TriTech Software Development Corp. ©2006-2019 TriTech Services Inc. All

rights reserved. Premium Pro® is a registered trademark.