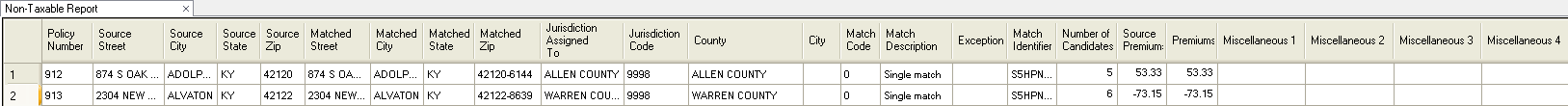

Non-taxable Report

The Non-taxable report lists addresses that are assigned to a non-taxable

municipal jurisdiction.

If the matching address meets these

criteria, it is given a match code of 9998 (or 999 in Florida modules

and 09999 in New York modules) and placed on the non-taxable report.

The columns in the Non-taxable report

are as follows:

Policy Number

Source Street

Source City

Source State

Source Zip Code

Matched Street

Matched City

Matched State

Matched Zip

Jurisdiction Assigned To

Jurisdiction Code

County

City

Match Code

Match Description

Exception

Match Identifier

Number of Candidates

Source Premiums

Premiums

Miscellaneous 1

Miscellaneous 2

Miscellaneous 3

Miscellaneous 4

The Non-taxable Report for South

Carolina will include the following four fields that are displayed after

Miscellaneous 4.

- Agent's Street

- Agent's City

- Agent's State

- Agent's Zip

- Agent's Address Used.

This field indicates if the option to Allocate On Agent's Address

was used. If so, the Matched Address will correspond to these

fields, not the source address.