Premium Pro Help

Detail Schedules

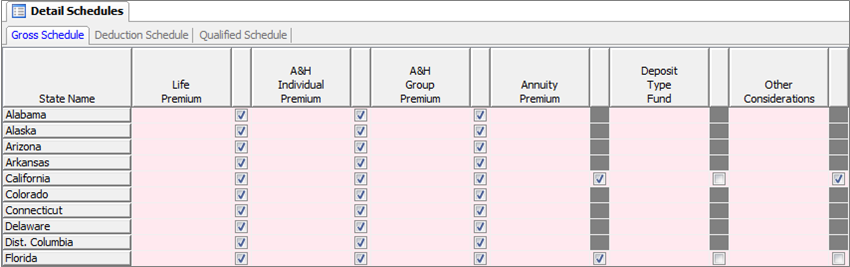

The Detail Schedules are comprised of three tabs for Life companies: Gross, Deduction and Qualified. There are two tabs for Property and Casualty companies: Gross and Deduction. These schedules enable you to enter a variety of different items for all states on one screen.

Gross Schedule

The first six columns source in the amounts entered

or calculated on the Schedule T. Here, you may

separate A&H premiums into Individual A&H

and Group A&H. These amounts are automatically

calculated from the premiums entered on the State

Business Page of each state. However, you may

change the breakout of A&H on this schedule

to affect all states. These columns are especially

useful for states like Nebraska, which tax Individual

and Group A&H at different rates. Please be

advised that Federal Employee Benefits and Medicare

premiums reported on the State Business Pages

are automatically excluded from the Individual

A&H amounts.

The next column will allow you to determine whether to include Dividends Applied to Paid Up Additions in your gross calculations.

The remaining three columns are for any other additional premiums specific to Life, A&H, and Annuities.

The checkboxes following each column indicate whether the premium amount will be included in the state calculations. Checkboxes for Annuity Premiums, Deposit Type Funds, and Other Considerations have been defaulted and/or disabled based on state statutes. The Total column will sum all items checked to be included in the total gross calculation.

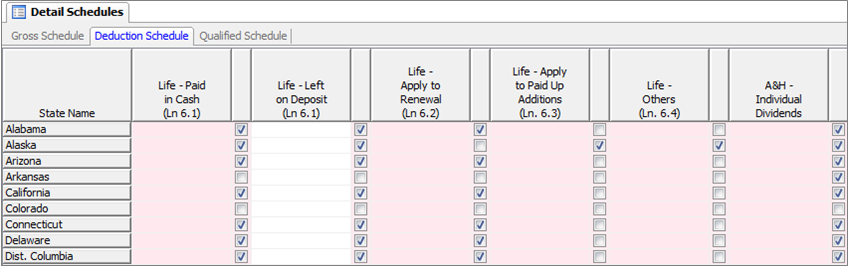

Deduction Schedule

The first five columns are designated for Life

Dividends. The amounts for these columns are automatically

calculated from the dividends entered on the State

Business Page of each state. These columns are

particularly useful if you do not have the State

Business Page(s) available and you wish to enter

the dividend amounts for all states in one location.

You may also separate Dividends Left on Deposit

and Dividends Paid in Cash.

The next two columns are used to separate A&H Dividends between Individual A&H and Group A&H. They are automatically calculated from the dividend amounts entered on the State Business Page(s) of each state. However, you may change the breakout of the A&H dividends on this schedule to affect all states. Please be advised that Federal Employee Benefits and Medicare dividends reported on the State Business Pages are automatically excluded from the Individual A&H dividends.

Columns 8 to 10 are used to enter Annuity Dividends. These amounts are also sourced from the dividends entered on the State Business Page(s) of each state. Again, if you do not have your State Business Page(s) available, you may enter the dividend amounts for all states in one location.

The next column provides a place to enter Return Premiums. Amounts entered in the Return Premiums column are deducted from the state's total gross premiums, unless the state law prohibits return premiums as a deduction. This is followed by columns that show the breakout for FEB Premiums and Medicare Premiums.

The remaining three columns are for any other premiums that need to be deducted from your gross premiums specific to Life, A&H, and Annuities. These columns are outlined in green designating that these fields contain adjustment schedules. Right click with your mouse to access the adjustment schedules in order to itemize your deductions with detailed descriptions.

The checkboxes following each column indicate whether the amounts will be deducted on the state return. If a checkbox is grayed out, the state does not allow this as an option. The Total column sums all items checked to be deducted from gross premiums.

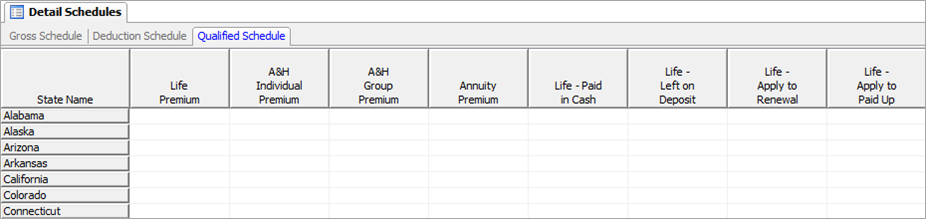

Qualified Schedule

This schedule is unique to the Life module and

it offers a location to enter Qualified Premiums

and Qualified Dividends for all states. If permitted

by state law, premiums entered on this schedule

are deducted from gross premiums. It may also

be used to separate premiums for states, like

California, that tax qualified premiums at a different

rate. If there is a need to separate the qualified

portion of dividends at the state level, the dividends

entered in this schedule will be particularly

useful.

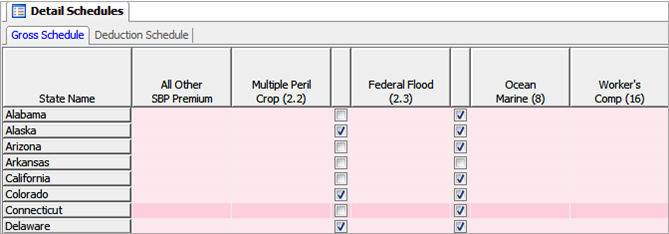

Gross Schedule

The first five columns source in the amounts

entered on the State Business Page for various

lines of Property and Casualty business, such

as Multiple Peril Crop, Federal Flood, Ocean Marine,

and Worker’s Compensation. For lines 2.2 and 2.3,

you may select whether or not the premiums are

taxable based on the check box selection immediately

following the premium column. The inclusion of

all other lines is based on state statutes. Changes

made by the user to the default value of the checkboxes

will transfer from year to year.

The next two columns are specific to Individual A&H and Group A&H premiums. These amounts are automatically calculated from the premiums entered on the State Business Page(s) of each state. However, you may change the breakout of A&H on this schedule to affect all states. These columns are especially useful for states like Nebraska, which tax Individual and Group A&H at different rates.

The following column is for Finance and Service Charges and is calculated from Column 8 of the Schedule T. Again, you may select whether or not this amount is taxable based on the check box selection immediately following the column.

The Net Premiums column will include all previously checked items. The remaining two columns are for any other additional premiums specific to P&C and A&H. Amounts entered here will be included in gross premiums for a given state when applicable.

The Total column will include all items checked to be included in the gross premiums for a particular state.

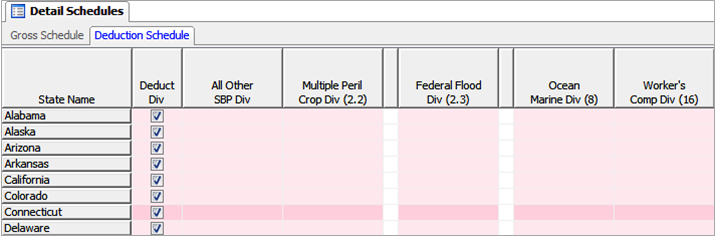

Deduction Schedule

The columns on this schedule mirror the columns

in the Gross schedule for the various lines of

business. However, the amounts listed here are

for dividend deductions. The check box for Deduct

Dividends will determine if the state will take

into account dividends when calculating taxable

premiums. Changes made by the user to the value

of the checkboxes will transfer from year to year.

The next column provides a place to enter Return Premiums. Amounts entered in the Return Premiums column are deducted from the state's total gross premiums, unless the state law prohibits return premiums as a deduction. This is followed by columns that show the breakout for FEB Premiums and Medicare Premiums. The next two columns are for P&C and A&H deductions. These columns are adjustment schedules. Right click with your mouse to access the adjustment schedules in order to itemize your deductions with detailed descriptions.

The Total Deductions column will include all applicable items that will be deducted on a given state return.

Our website address: www.tritechsoft.com

Our mailing address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions? You can reach us at 1-800-380-6407

Or contact WebSupport here.

©1995-2015 TriTech Software Development Corp. ©2006-2015 TriTech Services Inc. All rights reserved. Premium Pro® is a registered trademark.