Estimate Company Information

The Estimate Schedules provide a centralized location to both review and adjust the values that will be used when calculating the estimate returns.

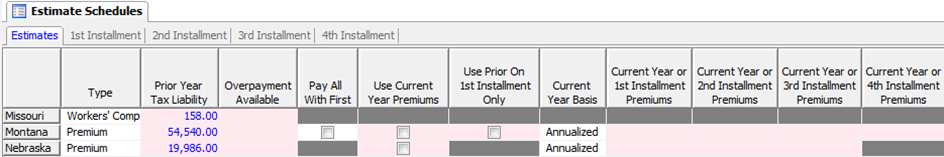

The Estimates Schedule provides lines for displaying all of the jurisdictions, and it also distinguishes between the various tax types for each state. When applicable, it will pull amounts such as the prior year tax liability and any overpayment that may be available from your annual returns.

The next column affects how the calculations are handled for a select number of states. Typically, states that require multiple estimated installments to be filed will also create multiple returns for taxpayers to use for these filings. However, some states provide all of their installment forms on a single-page return. The Pay All With First option allows users to determine whether or not they wish to fill out all of the applicable vouchers which appear on the first installment return in the software for a number of states. This allows you to print out a single page of estimates to use for your filings.

The Pay All With First option allows users to determine whether or not a single payment will be remitted for all applicable vouchers and/or installment returns for a number of states.

The Use Current Year Premiums option is available if the state allows you to make prepayments based on current year amounts. When this is the only option selected, the software will use the current year premium information from the columns labeled Current Year or Installment Premiums for up to four installments.

If you have chosen to calculate your prepayments based on current year premiums, you may also be given the option to choose to calculate your first installment using prior year premiums. When the Use Current Year Premiums and Use Prior On 1st Installment Only options are both selected, your prior year premiums will be used to calculate the first installment only, and all of the remaining estimates will calculate using the current year premium data. This option is useful if you do not have sufficient current year information available when the first installment is due.

The Current Year Basis column denotes the method used for reporting premiums on the various state returns. This will assist you when reviewing the premium amounts displayed in the Current Year or Installment Premiums columns.

The four columns labeled Current Year or Installment Premiums are used when calculating the estimate returns based on current year premiums. The amounts shown in these columns are calculated based on the information provided in the four detail schedules. A separate schedule exists for each of the Current Year or Installment Premiums columns. For example, the amount appearing in the Current Year or 1st Installment Premiums column comes directly from the amount reported in the 1st Installment schedule.

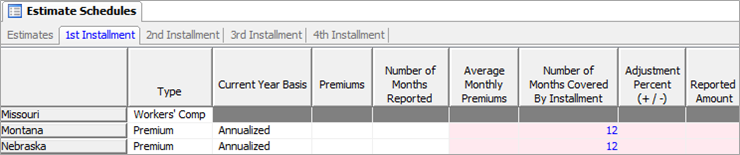

After the Estimates tab, you have four more tabs for the Installment Schedules. The Installment Schedules allow you to enter current year premium data on an installment-by-installment basis. The first three columns for the selected installment will display the state name, tax type, and current year basis to be used. These columns contain the same content and perform the same function as the columns bearing the same names which are located within the Estimates Schedule.

Enter your current year premium data for each of the available states in the Premiums column. The Number of Months Reported column allows you to specify how many months’ worth of premiums were reported in the Premiums column. The amounts provided in these two columns are then used to determine your Average Monthly Premiums for the current installment.

The Number of Months Covered By Installment column allows you to see how many months will be used to calculate the estimated premiums which will be used for the installment. By default, the numbers appearing in this column will typically be either three or twelve, depending on whether a state expects estimated payments to be based on quarterly or annualized premium amounts.

The Adjustment Percent column exists so that you can generate a premium volume over or under what would be estimated otherwise. This is especially useful when you do not have all of the current year information available for the installment you are preparing. Simply enter the percent you wish to use to increase or decrease your reported premiums. The amount in the Adjustment Percent column should be entered in decimal format (e.g., 0.1 would be used to increase reported premiums by 10%).

The Reported Amount column is calculated by taking the product of the Average Monthly Premiums, Number of Months in Installment, and the applied Adjustment Percent. This amount will then be transferred to the appropriate Current Year or Installment Premiums column on the Estimates Schedule.

The Filing Info Schedule in the Estimate module is identical to the Annual Filing Info Schedule, but it contains data for the estimate returns. You may change the address to which a return will be sent by selecting between the available addresses in the Address Option column. The address selected on this schedule will determine the Payee Address that will be used on the Filing Info Form, Estimate Check Request form, and labels for that particular return.

The corresponding State Filing Information page also functions the same in the Estimate module compared to the Annual module. Information specific to the estimate returns is listed on this page, such as Safe Harbor Rules which can be found in the Miscellaneous Notes section of the Estimate Filing Information page. !NEW for 2016-17

Our website address: www.tritechsoft.com

Our mailing address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions? You can reach us at 1-800-380-6407

Or contact WebSupport here.

©1995-2015 TriTech Software Development Corp. ©2006-2015 TriTech Services Inc. All rights reserved. Premium Pro® is a registered trademark.