Premium Pro Help

GFA Input Schedules

The input schedules are specific to each state and are accessible by activating the state from the Inactive Tree. The GTS-Life module contains one input schedule for Life, Annuity, and Health assessments whereas the PC module has separate input schedules for PC and Health assessments. Each schedule has the same columns.

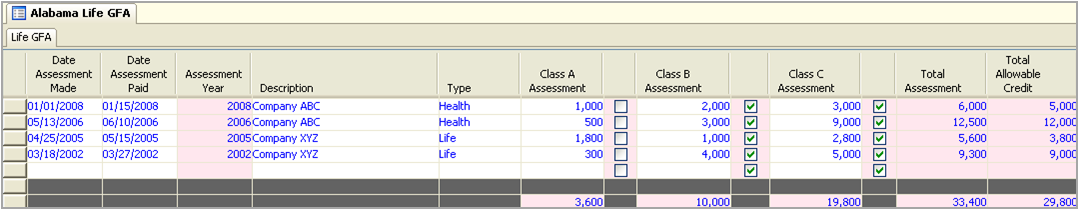

The first two columns in the input schedule are for the date the assessment was made and the date the assessment was actually paid. For each assessment you receive, you will enter the assessment date in the first column, and then in the second column you will enter in the date you remitted the payment.

The column for Assessment Year will automatically populate based on the information provided in the first two columns and the selected GFA state options. We will default these options based on our tax research. You can access the GFA state options from the Options node located under Company Information in the Active Tree. The next column is for the description of the assessment. Here you may enter in the name of the fund or insolvent company.

There is also a column for the Type of assessment. For Life companies, you may use the dropdown box to select Life, Health, or Annuity. For PC Companies, the PC GFA schedule allows you to select between Auto, Worker’s Comp, and Other, whereas the Health schedule only contains a selection for Health.

The next three columns are designated for Class A, B, and C assessments. Enter the amount for each class and then verify the check boxes next to each column. If the column is checked, this indicates that you may receive a credit for the assessment amount.

The Total Assessment column simply adds the Class A, B, and C assessments entered.

The Total Allowable Credit column indicates the total amount of assessment that can be used to determine GFA credit. This will be the sum of the Class A, B, and C assessments if checked. The software will then transfer the amount of available credit for each year, based upon the assessment year and relevant state regulations, to the GFA Input Schedule located in the Annual module. This reduces the time spent entering data in both places, since the software automatically carries the amounts from one module to another.

The last set of columns covers a twenty-year period. These columns will populate with the corresponding credit amount that was previously taken or is available for upcoming years.

Our website address: www.tritechsoft.com

Our mailing address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions? You can reach us at 1-800-380-6407

Or contact WebSupport here.

©1995-2015 TriTech Software Development Corp. ©2006-2015 TriTech Services Inc. All rights reserved. Premium Pro® is a registered trademark.