Premium Pro Help

GFA Summary Schedules

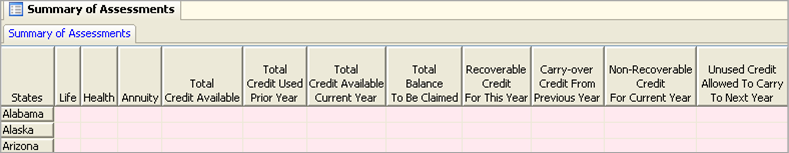

The Summary of Assessments is a compilation of amounts that apply for the current tax year. The first set of columns summarizes the total amount of assessments for any given state.

The next two columns provide you with the total credit available for each state and also the total credit used in the prior year. If this is your first year using the GFA Tracking module you will need to manually enter amounts into the Total Credit Used Prior Year column. After that, the software will keep track and update this amount year after year.

The next column, Calculated Credit Available for the Current Year, is calculated from the total credit amount in the current filing year column from each state’s input schedule in the GFA Tracking System.

The Carryover Credit column lists the amount of unused credit allowed to carryover from the previous year.

The Total Credit Available Current Year is the sum of the preceding two columns, Credit Available for the Current Year and the Carryover Credit from the preceding two columns.

The next column details the amount of recoverable credit for the current year. This number should correspond with the GFA Credit amount in the Summary of Taxes Schedule, located in the Annual module.

The Non-Recoverable Credit column displays any lost credit that cannot be carried over.

The following column is for Unused Credit Allowed to Carryover to the next year. This information will rollover to the Carry-over Credit From Previous Year column in the following year’s Summary of Assessments.

The last column is designated for the Total Balance to be Claimed. This will display the total amount of GFA credit allowed for future use on a state-by-state basis.

Our website address: www.tritechsoft.com

Our mailing address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions? You can reach us at 1-800-380-6407

Or contact WebSupport here.

©1995-2015 TriTech Software Development Corp. ©2006-2015 TriTech Services Inc. All rights reserved. Premium Pro® is a registered trademark.