Premium Pro Help

New York State Specifics

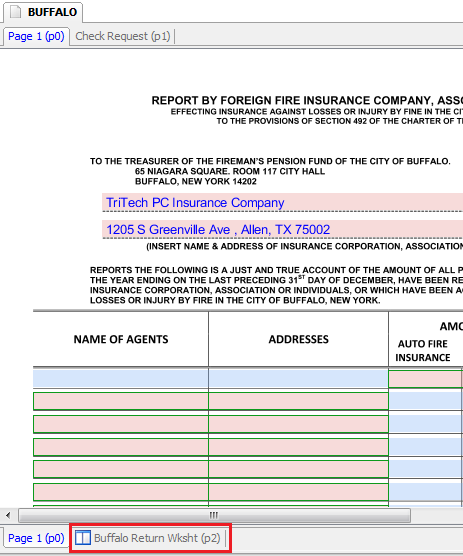

The New York module consists of the City of Buffalo Foreign Fire Tax Report, the New York City Foreign Fire Premiums Tax Report, and the Cover Letter for the New York State Foreign Fire Tax Report. The Buffalo Fire Tax is prescribed by the Provisions of Section 492 of the Charter of the City of Buffalo. The City of New York Fire Tax is prescribed by Title 11, Chapter 9 of the NYC Administrative Code.

Worksheets have been added to all the returns to show the detail of the import in the New York module. !NEW for 2016-17

You may also now use a digitized signature on the New York City returns as well. !NEW

The New York State Foreign Fire Tax Program is set forth in New York Insurance Law 9104 and 9105. The foreign and alien stock and mutual insurance companies are required to file a report of fire premiums written, allocated by fire districts, and remit payment of the 2% tax. A Report must be submitted identifying tax due by fire district/ department, in either a text file or Excel file. The text file can be generated in Premium Pro Allocator. In Premium Pro Municipal, a cover letter that accompanies the payment and the report is included.

The Input Schedule of the New York module is comprised of columns for 7 premium types; you can set the percentage for each type in the Rate & Fee Schedule. Please note that the 5 boroughs of the City of New York are listed in the Input Schedule, the total premiums of these boroughs are sourced into the New York City return. For the Buffalo return, the Auto premiums plus the Auto adjustments on the Input Schedule times the applicable percentage are sourced into the Auto Fire Insurance field, while all other types of the premiums plus the adjustments times the applicable percentages are flown into the All Other Fire Ins field.

New York Line of Business and Percentage

The following guidelines may assist you in determining the appropriate Line of Business and Percentage for specified risks. Since the NY Department of Financial Services does not provide an official guideline, you can keep using your methods as long as they are approved by the Department.

NAIC Annual Statement Line |

Municipal Input Schedule Line |

Percentage |

| 1 Fire | Fire Premiums and Fire Adjustments | 100% |

| 3 Farm Owners' multiple peril | Farm-owners and Farm-owners Adjustments | 50% or 35%* |

| 4 Homeowners multiple peril | Home-owners and Home-owners Adjustments | 35% |

| 5.1 Commercial multiple peril | Commercial Multiple Peril and Commercial Multiple Peril Adjustments | 50% |

| 21.1 Private passenger auto physical damage | Auto Premiums and Auto Adjustments | 11% |

| 21.2 Commercial auto physical damage |

* If a multi-peril policy, covering such property, has an indivisible property premium, the accepted fire portion would be 50 percent of such premium. If such multi-peril policy has an indivisible property and liability premium, the accepted fire portion would be 35 percent of such premium. 50 percent is used in the Rate & Fee Schedule in the software.

Our website address: www.tritechsoft.com

Our mailing address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions? You can reach us at 1-800-380-6407

Or contact WebSupport here.

©1995-2015 TriTech Software Development Corp. ©2006-2015 TriTech Services Inc. All rights reserved. Premium Pro® is a registered trademark.