Premium Pro Municipal Tax

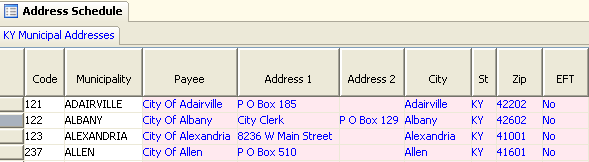

This schedule contains the due date, payee, and mailing information for all municipalities. Any overrides made on this schedule will flow to both the return and applicable check requests. However, only overrides to the vendor numbers will roll over to subsequent year Address Schedules.

Although many states dictate a due date for municipal returns in the state statutes, some municipalities have adopted due dates that may differ from the statutes. As a result, the due dates for all municipalities found in a state module may not be the same. You may change the date in this schedule for all or selected municipalities. Any date entered here will override the default due date appearing on all municipal returns.

Phone numbers and vendor numbers for each municipality are included in the schedule. Vendor numbers entered in the prior year Address Schedule roll to the appropriate municipality on the current year Address Schedule. Vendor numbers that have not been rolled over from the prior year should be entered into this schedule. The number then sources to each check request.

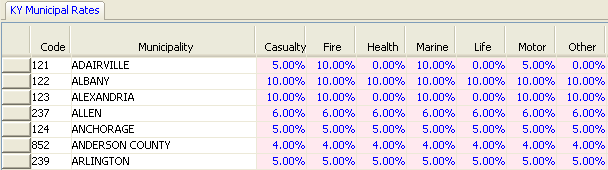

The Rate and Fee schedules provide a listing of all applicable rates and/or fees for all municipalities within a given state. Any overrides made on this schedule will flow to or be used in the municipal calculation. However, overrides will not roll over to subsequent year Rate schedules.

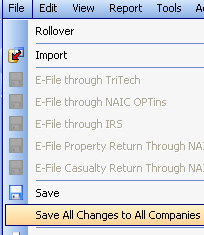

To have the changes you make to the address and rate schedules apply to all companies, go to File, then choose Save All Changes to All Companies. This option is available for all municipal modules except KY.

Overrides will appear in red. To go back to the default value, click on the cell with the override and then hit Ctrl + O.

Our website address: www.tritechsoft.com

Our mailing address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions? You can reach us at 1-800-380-6407

Or contact WebSupport here.

©1995-2015 TriTech Software Development Corp. ©2006-2015 TriTech Services Inc. All rights reserved. Premium Pro® is a registered trademark.