The Payment Request Schedule is the same format as on the Annual side, but contains the data for the estimated payments. The Summary of Taxes, however, is different from its Annual counterpart.

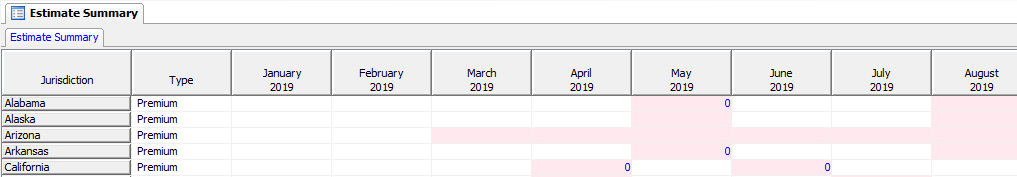

The Estimate Summary will display the calculated tax due on the estimate returns in the applicable month(s). Your total prepayments and any credit not refunded will appear on this schedule. The Type column shows a breakout of the various estimated amounts by tax type (i.e., Premium Tax, Retaliatory Tax, etc.). There is a Total column that sums the prepayment amounts in the preceding columns. The Total Credit column lists any prior year overpayment that was not refunded. The new Total Prepay & Credit column sums the Total Prepay & Total Credit columns. This information transfers to the Prepayments Schedule in the Annual Module for the following tax year.

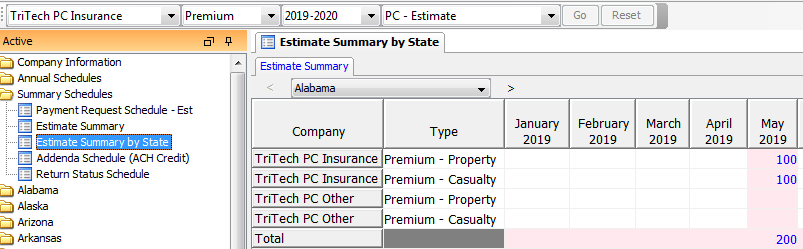

Similar to Summary of Taxes in the Annual module, the Estimates Summary by State schedule shows the estimate summary of taxes for all companies by state, allowing you to see prior year or current basis information.

The Payment Request Export feature is also available in the Estimate module. This feature allows you to export the information in the Payment Request Summary to an ASCII file that can then be imported into your accounts payable system. This feature works the same in the Estimate module as it does in the Annual module.

Our website address: www.tritechsoft.com

Our mailing address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions? You can reach us at 1-800-380-6407

Or contact Support here.

©1995-2019 TriTech Software Development Corp. ©2006-2019 TriTech Services Inc. All rights reserved. Premium Pro® is a registered trademark.